What Is An Outstanding Deposit?

As of May 2022, the total amount of demand deposit accounts in the U.S.—officially, the total demand deposits component of M1—was $4.98 trillion. This compares to $1.4 trillion five years ago and $733 billion 10 years ago. If both the balances are equal, it means the bank reconciliation statement has been prepared correctly.

A nonrefundable deposit means you never, ever get it back under any circumstances whatsoever. There could be good reasons why you may change your mind later about buying this business. For example, the seller may have cooked the books by inflating his revenues and profits. Or perhaps the owner’s landlord won’t let you take over the lease of the business’ storefront location.

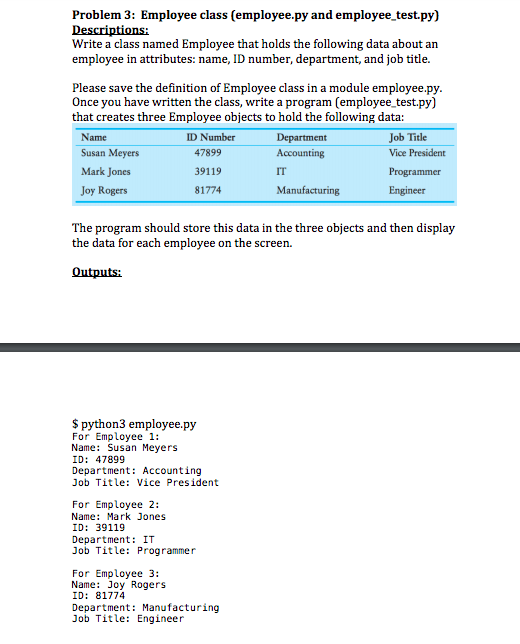

How Do I Reconcile Outstanding Checks with My Bank Statement?

But, the cheque has not yet been cleared by the bank as a deduction from the company’s cash balance. Deposits in transit are also referred to as outstanding deposits. Such deposits are not showcased in the bank statement on the reconciliation date. This happens due to the time lag between when your business deposits cash or a cheque into its bank account and when your bank credits the same. Balancing your checkbook is the process of reconciling the bank’s record of your account activities with your own. Banks use debit memoranda to notify companies about automatic withdrawals, and they use credit memoranda to notify companies about automatic deposits.

The bank will debit your business account only when the bank pays these issued cheques. However, there might be a situation where the receiving entity may not present the cheques issued by your business to the bank for immediate payment. When you compare the balance of your cash book with the balance showcased by your bank passbook, there is often a difference. After adjusting all the above items, what you get is the adjusted balance as per the cash book. The outstanding deposits on the Reconciliation tab is correct the value on the summary tab is incorrect. These are items that haven’t yet shown as transactions in your account, but that you’re certain will be credited.

DDA can also stand for “direct debit authorization,” meaning a transaction, such as a transfer, cash withdrawal, bill payment, or purchase, which has immediately subtracted money from the account. In order to prepare a bank reconciliation statement, you need to obtain the current as well as the previous month’s bank statements and the cash book. In such a case, your bank has recorded the receipts in your business account at the bank. However, you did not record such a transaction in your cash book. As a result, the balance showcased in the bank passbook would be more than the balance shown in your company’s cash book.

Examples of Outstanding Deposits in a sentence

The practice of reconciling your bank account, which simply means matching your transactions to the amount of money in your account, does not have to be a daunting task. Like your personal bank statements, your business bank statements will include records of fees, returned checks, deposits, withdrawals, and ACH debits. An outstanding deposit is that amount of cash recorded by the receiving entity, but which has not yet been recorded by its bank. All outstanding deposits are listed as reconciling items on the periodic bank reconciliation prepared by the receiving entity. These deposits are subtracted from the book balance of the receiving entity to arrive at the bank balance.

Irish banks slower to pass on rate increases to savers – RTE.ie

Irish banks slower to pass on rate increases to savers.

Posted: Wed, 06 Sep 2023 15:26:08 GMT [source]

Is there a similar repair that can be done to the BKTRAND, BKTRANH files. I have had to do this as it relates to outstanding withdrawals – but that was for items that remained on the outstanding list on the reconciliation tab needing to be removed. In this case it is deposits and the list on the reconciliation tab is the accurate one – its the value on the summary tab that is inaccurate. If you don’t balance your checkbook, you won’t know for certain how much money you have available in your account, which makes you more likely to make a mistake and overdraw your account.

Errors Committed by your Business While Recording Transactions

It is important to note that such charges are not recorded by you as a business till the time your bank provides you with the bank statement at the end of every month. Then, subtract outstanding items such as withdrawals and payments that haven’t yet shown up as transactions but which you know will hit your account soon. For example, you might have written a check to somebody who has not yet cashed it.

So, this means there is a time lag between the issue of cheques and its presentation to the bank. This is also known as unfavorable balance as per the cash book or unfavorable balance as per the passbook. Not what is notes payable Sufficient Funds (NSF) refers to a situation when your bank does not honour your cheque. This is because the current account on which the cheque is drawn does not have sufficient funds to honour the cheque.

Now that you’ve reviewed every transaction, your account should be free of any surprises. Once you’ve added the deposits and subtracted https://online-accounting.net/ the debits, you’ll see the new balance of your account. Here are some reasons why you should keep tabs on your bank account.

All deposits and withdrawals undertaken by the customer are recorded both by the bank as well as the customer. The bank records all transactions in a bank statement (also known as passbook) whereas the customer records all their bank transactions in a cash book. Interest income reported on the bank statement has usually not been accrued by the company and, therefore, must be added to the company’s book balance on the bank reconciliation. The final transaction listed on the Vector Management Group’s bank statement is for $18 in interest that has not been accrued, so this amount is added to the right side of the following bank reconciliation. You can also use bank statement reconciliation to track your business’s progress.

As mentioned above, the process of comparing your cash book details with the records of your business’ bank transactions as recorded by the bank is known as bank reconciliation. You first need to determine the underlying reasons responsible for the mismatch between balance as per cash book and passbook. Once you have determined the reasons, you need to record such changes in your books of accounts. Such a time lag is responsible for the differences that arise in your cash book balance and your passbook balance. The purpose behind preparing the bank reconciliation statement is to reconcile the difference between the balance as per the cash book and the balance as per the passbook.

Deposits Outstanding Incorrect

In addition, there may be cases where the bank has not cleared the cheques, however, the cheques have been deposited by your business. Therefore, the bank needs to add back the cheque’s amount to the bank balance. Once you complete the bank reconciliation statement at the end of the month, you need to print the bank reconciliation report and keep it in your monthly journal entries as a separate document.

- This is because when you deposit a cheque in your bank account, you consider that the cheque has been cleared by the bank.

- Online payments offer a more direct way of transferring the funds between you and the payee.

- Even if the checkwriter has sufficient funds, any delay from the depositor simply means higher interest revenue on the capital balance waiting to be drawn down.

- As a result, the balance showcased in the bank passbook would be more than the balance shown in your company’s cash book.

- There’s lots to worry about and it takes time to do your accounting processes accurately.

To prevent problems, you should cash or deposit a check promptly after receiving it. Like business checks, personal checks are generally considered invalid after six months (180 days). Outstanding personal checks can cause budgeting problems, but you may have an easier time reminding a friend or family member to cash a check than a business payee.

This calculator will help you correct any discrepancies between your account register and your account balance. First input the needed information into the “Balances” section, which includes the balance listed on your checking register and the ending balance listed on your bank statement. Businesses must track outstanding items to avoid breaking unclaimed property laws. If payments to employees or vendors remain uncashed, they eventually must turn over those assets to the state. This typically occurs after a few years, but timetables vary from state to state.

The very purpose of reconciling the bank statement with your business’ books of accounts is to identify any differences between the balance of the two accounts. Once the adjusted balance of the cash book is worked out, then the bank reconciliation statement can be prepared. In this way, the number of items that cause the difference between the passbook and the cash book balance gets reduced. Furthermore, it gets easier to ascertain the correct amount of balance at the bank in the balance sheet.

After receiving the bank statement, therefore, the company prepares a bank reconciliation, which identifies each difference between the company’s records and the bank’s records. The normal differences identified in a bank reconciliation will be discussed separately. A bank reconciliation begins by showing the bank statement’s ending balance and the company’s balance (book balance) in the cash account on the same date. A check previously recorded as part of a deposit may bounce because there are not sufficient funds in the issuer’s checking account.